Copied from CASEY breaking news...

You are receiving this sponsor-paid news release as a Casey Research

subscriber. You may opt out of these news releases at any time, by clicking here. The distribution of this news does not constitute a recommendation or advice of any kind.

PRESS RELEASE

TSX Venture: MAT

OTCQX: MHREF

TSX Venture: MAT

OTCQX: MHREF

Matamec Announces Results of Positive Feasibility Study for Kipawa JV Heavy Rare Earth Project

Montreal, September 4, 2013 - Matamec Explorations Inc. (“Matamec”

or the “Company”) is pleased to announce the positive results of the

Feasibility Study (“FS”) for the Kipawa Joint Venture (“JV”) Heavy Rare

Earth Elements Project (“HREE”) (“the Project”). The FS was prepared

by Roche Ltd. and GENIVAR Inc. and supported by SGS Geostat and Golder

Associates Ltd. FS results show that the Project is technically and

economically feasible. An analyst’s conference call will be held today

at 10:00 a.m. ET. All numbers are reported in Canadian dollars unless

otherwise stated. The goal of the Kipawa JV is to supply Toyota Tsusho Corp. (“TTC”) with heavy rare earths such as dysprosium which is indispensable for hybrid and electric vehicles. The JV partners are presently in discussions and evaluating next steps to advance the project.

KIPAWA HREE PROJECT – FS FINANCIAL MODEL HIGHLIGHTS

|

|

Net Present Value (NPV10%) (Pre-Tax)

|

$260 million

|

Internal Rate of Return (IRR) (Pre-Tax)

|

21.6%

|

Revenue

|

$2.55 billion

|

EBITDA

|

$1.37 billion

|

CAPEX (initial)

|

$374 million

|

OPEX (annual)

|

$78.5 million

|

Payback Period (Pre-Tax)

|

3.9 years

|

Life of Mine (LOM)

|

15.2 years

|

Concentrate Production (annual avg.)

|

3,653 tonnes

|

- The Company is committed to bringing the IRR above 25% by continuing to reduce the required CAPEX and OPEX, while optimizing the overall recovery rate.

ECONOMIC SUMMARY OF 2012 PEA VERSUS 2013 FEASIBILITY STUDY RESULTS

|

||||

Metric

|

PEA Quantity March 2012

|

FS Quantity August 2013

|

Unit

|

|

| Total Mine Revenue |

2.822

|

2.548

|

$ billion | |

EBITDA

|

1.68

|

1.37

|

$ billion | |

Pre-production Capital Expenditures (initial)

|

315.8

|

374.4

|

$ million | |

| Sustaining Capital Expenditures (incl. rehab.) |

38.2

|

37.7

|

$ million | |

Additional Working Capital Requirement

|

9.9

|

11.2

|

$ million | |

| Mine Rehabilitation Costs |

7.5

|

23.1

|

$ million | |

| Total Operating Costs |

1.142

|

1.181

|

$ billion | |

| Total Before-tax Cash Flow |

1.335

|

960

|

$ million | |

| Total Basket Price after discount |

42.08

|

50.12

|

$ /kg | |

| HREO* Basket Price - concentrate |

-

|

39.79

|

$ /kg | |

| LREO** Basket Price - concentrate |

-

|

10.33

|

$ /kg | |

| Economics (Pre-Tax) | ||||

| IRR |

36.9

|

21.6

|

% | |

| NPV @ (PEA 5%) (FS 6%) |

811

|

450

|

$ million | |

| NPV @ 8% |

606

|

344

|

$ million | |

| NPV @ 10% |

500

|

260

|

$ million | |

| NPV @ 12% |

-

|

191

|

$ million | |

Payback Period

|

2.4

|

3.88

|

years | |

| Economics (After-Tax) | ||||

| IRR |

-

|

16.8

|

% | |

| NPV @ (PEA 5%) (FS 6%) |

-

|

257

|

$ million | |

| NPV @ 8% |

-

|

185

|

$ million | |

| NPV @ 10% |

-

|

128

|

$ million | |

| NPV @ 12% |

-

|

81

|

$ million | |

Payback Period

|

-

|

4.12

|

years | |

| Mining | ||||

| Mineral reserves |

19.00

|

19.77

|

millions of tonnes | |

| Production rate (ore) |

4,110

|

3,650

|

tonnes per day | |

| Life of Mine |

12.9

|

15.2

|

years | |

| Total CAPEX (based on 3,653 tpa) |

86.50

|

102.57

|

$ /kg (+18%) | |

| Total OPEX (based on 3,653 tpa) |

24.44

|

21.53

|

$ /kg (-13%) | |

| Total Operating Costs |

24.44

|

21.53

|

$ /kg | |

General and Administration

|

8.84

|

11.6

|

$ million per year

|

|

| Mining |

16.61

|

18.1

|

$ million per year

|

|

| Process |

58.35

|

48.7

|

$ million per year

|

|

| Total Recovery Rate*** |

81

|

70

|

% | |

| Heavy average |

-

|

74

|

% | |

| Light average |

-

|

65

|

% | |

**LREO – Light Rare Earth Oxide (Ce, La, Nd and Pr).

***Samples used for PEA represent only the Western part of the deposit whereas FS samples represent the whole deposit.

KIPAWA JV FEASIBILITY STUDY RESULTS HIGHLIGHTS

|

Environmental and Permitting Process

A complete environmental baseline study will be finalized by fall 2013; Environmental and Social Impact Assessment is subjected to the Canadian Environmental Assessment Agency, which will be available Q1 2014. The project notice to begin the Federal environmental permitting process was submitted before the end of Q1 2013 and the official application for the Certificate of Authorization to the Provincial “Ministère du Développement durable, de l’Environnement, de la Faune et des Parcs” (MDDEFP) is planned to be submitted by winter 2014. |

Social Acceptability

Since 2009, Matamec has been committed to engaging the Temiscamingue communities to include and take into consideration their concerns in the development of the Project. |

Mineral Resource Estimates

Total measured and indicated resource now stands at 23.857 million tonnes at 0.407% Total Rare Earth Oxide (TREO) representing 88% of total resource. |

Mineral Reserve

Mine – total projected ore tonnage is 19.8 million tonnes with a TREO diluted grade of 0.4105%. |

Mining

Projected to produce an avg. 1.33 million tonnes of ore per year (3,650 tonnes per day) and avg. stripping ratio of 0.94 with 15.2 years mine life (excluding pre-production period). |

Metallurgical Plant Site

The final products of the process plant will be a chloride concentrate of HREE and a concentrate of LREO. FS results show a lower recovery compared to the PEA study, but it also shows that the process is working for the entire ore body, and highlights where the process has to be optimized in order to improve the recovery. From the previous results, a new Master Composite of ore is ready for further piloting planned for fall 2013 to improve the process. |

PROJECT DEVELOPMENT – PLANNED NEXT STEPS

|

|

Milestone

|

Timeline

|

Second Pilot Plant

|

Fall 2013

|

Environmental and Social Impact Study

|

Q1 2014

|

Environmental Process – Federal and Provincial

|

Now to Q1 2015

|

Development of off-take agreement

|

2014

|

Financing CAPEX Process

|

2014

|

Detailed Engineering

|

2014 to mid-2015

|

Construction of Mine

|

Q1 2015 to Q4 2016

|

Start-up of Mining Operation

|

Q4 2016

|

Mr. Gauthier commented, “The Company will work with government authorities to ensure that all required areas are covered to receive environmental permits. We have assembled a highly qualified team who are focused on identifying every risk possible to ensure the environment is given the utmost respect and protected for future generations. The Company will continue its outreach efforts with the community which we have been developing over the past four years to create greater comprehension and visibility for the project. We welcome and value the concerns of the citizens of the Temiscamingue region and look forward to working together in building a sustainable plan.”

Additional Upside Opportunities for the Kipawa Mine Project

Matamec has identified a number of opportunities that have the potential to add additional value to the project.

- The second metallurgical pilot plant testwork should be conducted in addition to the bench scale and first pilot plant testwork conducted up to now. This second pilot plant testwork will be important to confirm, prior to detailed engineering, final sizing of some process equipment. For the time being overcapacities have been built into the design, but it could be reduced during the detailed engineering, pending the pilot plant results. The second pilot plant will also help to confirm improvements in regards of recovery rates since conservative numbers were used for the FS.

- It would be significant to consider some testworks to separate individual Rare Earths (RE) to increase the value of the project.

- Depending on the RE market conditions, it will be important to continue the evaluation of other LREE concentrates and HREE concentrates production scenarios in order to optimize the IRR before detailed engineering.

- In the future and when the project is well in progress, testwork can be performed to evaluate the possibility to recovering zirconium and other minor metal by-products in the RE mineralized zones and in the syenite body.

- Mineral resources on the Kipawa deposit can be increased by verification of lateral and down dip extensions by drilling.

- From the last results in the FS it is known that there is the potential room for improvement in the open pit design when entering the detailed engineering phase.

Review of the FS Project Development Model

The FS covers all aspects of project development, including mining, mineral concentration, hydrometallurgical processing and separation of heavy and light rare earth as well as all related infrastructure. Roche developed its capital and operating cost estimates from first principle capital quotations, estimates from suppliers, manufacturers, contractors and experience based on comparable operations in Canada and abroad. The capital and operating cost estimates were completed to a level consistent with an intended level of accuracy of ± 15%.

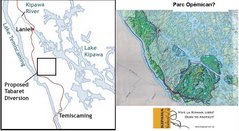

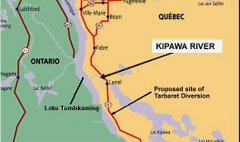

Project Location

The Kipawa deposit is located on the Zeus Property (see map below), 50 km east of the town of Temiscaming and 140 km south of Rouyn-Noranda, Quebec. All claims are in good standing. Resources are not subject to any third party royalties.

General Project Infrastructure Description

About 50 km of the Maniwaki road will be used to access the Kipawa Project and share with public and other logging companies. Then a 4 km road will be built from the Maniwaki road to reach the process plant site.

The Kipawa mining site will consist of the open pit mine, a waste dump, a low grade stockpile and a high grade truck loading facility. The mine equipment maintenance facility will also be located at the mine site.

The metallurgical process plant site will be located south of the mine site and south of the Kipawa River and a 10 km haul road will be built to link the two sites. The metallurgical site will consist of the ore process plant which will combine the crushing, grinding, magnetic separation and hydrometallurgical circuits. At this site, there will also be the administration and service building, a warehouse and the assay laboratory.

There will be two dewatered tailing storage facilities; one storage facility will be for the rejects of the magnetic separation process located just by the process plant and one other storage facility for the hydrometallurgical tailing located about 4 km south of the process plant.

The employee’s parking and the main electrical sub-station will be located near the town of Temiscaming. In the present study it is planned to build a 44kV power line along the Maniwaki logging road to provide power to the mining and processing facilities.

Geology, Mineralogy and Mineralization

The ore deposit is defined by three enriched horizons within the “Syenite Complex”, which contains the fifteen rare earths elements present. The Kipawa Alkaline Intrusive Complex consists of peralkaline syenite and granite on average is less than 200 metres thick. It’s an elongated, V-shaped body folded around a major southeast plunging anticline. The west limb of this fold includes the Kipawa deposit, which is entirely included within the lower syenite layer of the complex. This mineralized syenite layer is a concordant sheet 50 to 80 meters thick that gently dips 20 to 30 degrees to the south-west. The deposit outcrops over 1.4 km along strike with an additional outcrop discovered 220 m to the north-west during the summer 2011 exploration campaign.

Rare earth-yttrium-zirconium mineralization at the Kipawa deposit is contained in medium grained silicate minerals. Grains are distinct and generally well crystallized. Three minerals are presently considered economical in the Kipawa deposit, namely eudialyte (a sodic silicate), yttro-titanite/mosandrite (titanite silicate) and britholite (calsic silico-phosphate) for the rare-earth and yttrium, with minor amounts of apatite also present. Vlasovite/gittensite (sodic silicates) and eudialyte (sodic silicate) are also considered for a potential zirconium by-product.

Three vertically-stacked mineralized zones have been defined based on their spatial characteristics: the Eudialyte (60% of existing rare earth-yttrium resources), Mosandrite (25% of existing rare earth-yttrium resources) and Britholite (15% of existing rare earth-yttrium resources) zones. Despite their name, the different zones contain a mix of the potentially economic minerals. The name simply indicates the dominant REE mineral present in that zone. The main Eudialyte zone, for example, consists of intermixed eudialyte (51%) and mosandrite/yttro-titanite (39%) with trace britholite (10%). It sits near the top of the syenite body and is not associated with any large calco-silicate horizon. Note that all zones outcrop at surface.

The Kipawa deposit contains very low-levels of uranium and thorium in the main REE-Zr mineralization. Average values of Th (193 ppm, or 0.019%) and especially U (22 ppm, or 0.002%): though higher than in the surrounding rocks remains very low in the mineralized syenite portion of the Kipawa deposit. Initial results suggest that most of the thorium is contained in coarse-grained urano-thorite and ekanite crystals, while the uranium is disseminated within said urano-thorite and rare-earth minerals.

The terms “Mineral Resource” and “Mineral Reserve” are defined in the CIM Definition Standards - For Mineral Resources and Mineral Reserves adopted by the CIM council of the Canadian Institute of Mining, Metallurgy and Petroleum.

Mineral Resources

The Kipawa Deposit resource are 10,478,000 tonnes at 0.46% TREO in the measured category, 13,379,000 tonnes at 0.36% TREO in the indicated category and 3,268,000 tonnes at 0.31% TREO in the inferred category. The total of measured and indicated resource now stands at 23,857,000 tonnes at 0.41% TREO representing 88% of the total resource. These results are at a 0.2% TREO cut-off and are not limited by an open pit. The overall total tonnage is about 10% greater than the last resource calculation (see press releases dated June 30 and July 7, 2011).

The Kipawa deposit’s mineral resource estimates were updated by SGS Geostat. The drilling done since the 2011 PEA (see press release dated January 30, 2011) totaling 14,293 m was included and permitted to outline some measured resources for the first time in the history of the project. The database now totals 293 drill holes totaling 24,571 m and 13 trenches totalling 631 m. Historical Unocal holes are not in the count and were not used for the estimates. The mineralized zones were interpreted on vertical sections and meshed into volumes as per industry standards. Ordinary Kriging was used to estimate the block model with block size set at 10 m x 5 m x 5 m. The measured and indicated resources required drill grids of 25 m and 50 m, respectively. Resources extrapolated beyond 30 m of those drill grids are considered inferred.

Mineral Reserves

By using SGS Geostat model, the mineral reserve for this FS was prepared, estimated and supervised by Roche using a cut-off value of $48.96/t with 5% dilution and a mining recovery of 95.2%. The Kipawa open-pit design utilized a marginal (or milling) cut-off value of $48.96/t and a break even cut-off value of $60.70/t. Included in the reserves are 632,000 tonnes of low grade material lying between these 2 cut-offs values. This material will be sent to a low grade stockpile, close to the mine site and will be processed at the end of operation after mine depletion.

In-pit Mineral Reserves

|

Metric Tonnes

|

Proven (51.7% of the deposit)

|

10,219,000

|

Probable (48.3% of the deposit)

|

9,550,000

|

Total

|

19,769,000

|

Total Grade

|

|

Cerium (Ce2O3)

|

0.1195

|

Lanthanum (La2O3)

|

0.0588

|

Praseodymium (Pr6O11)

|

0.0146

|

Neodymium (Nd2O3)

|

0.0550

|

Samarium (Sm2O3)

|

0.0123

|

Europium (Eu2O3)

|

0.0015

|

Gadolinium (Gd2O3)

|

0.0119

|

Terbium (Tb4O7)

|

0.0022

|

Dysprosium (Dy2O3)

|

0.0147

|

Holmium (Ho2O3)

|

0.0032

|

Erbium (Er2O3)

|

0.0101

|

Thulium (Tm2O3)

|

0.0016

|

Ytterbium (Yb2O3)

|

0.0096

|

Lutetium (Lu2O3)

|

0.0013

|

Yttrium (Y2O3)

|

0.0943

|

TREO

|

0.4105

|

Design Basis

The Total Rare Earth Oxides (TREO) diluted grade is 0.4105%

including a dysprosium (Dy2O3) diluted grade of 0.0147%. The

calculation is using a dilution grade of 0.093% TREO. The recoveries

for each element vary from 65% to 74% for a TREO average of 70% for the

10 main REO which are (La2O3, Ce2O3, Pr6O11, Nd2O3, Sm2O3, Eu2O3,

Gd2O3, Tb4O7, Dy2O3 and Y2O3). A total production of TREO is expected

to be 55,529 tonnes over the mine life. When the mine will be in full

production (year 2-15) an average of 3,760 tonnes per year of TREO will

be produced.Mining

The mine will produce an average of 1,332,250 tonnes of ore per year (3,650 tonnes per day) and has an average stripping ratio (waste : ore - without the overburden) of 0.94 with a mine life of 15.2 years. A standard 55 tonne mining truck and shovel operation will bring the drilled and blasted material out of the mine to their respective destinations (waste dump, low grade stockpile or high grade loading facility). Then the ore is transported by 40 tonne HD dump trucks to the metallurgical plant site.

Processing

Once at the metallurgical plant site, the ore will be dumped into a crusher dump hopper feeding a two stage crushing circuit. The crushed ore will then be stored into a silo. The crushed ore will feed the process plant at the rate of 3,650 tpd in a single stage grinding circuit. A magnetic separation circuit will recover the rare earth as a first concentrate. The reject from the mag-sep circuit will be pumped to the dewatering circuit and transported by truck to the mag-sep rejects storage facility located outside and nearby the process plant. The magnetic rare earth concentrate will be sent into the regrind mill followed by a thickening circuit and then to the hydrometallurgical process (acid leaching, neutralization, impurities removal and the final precipitation) will then produce the rare earth carbonate concentrates. This hydromet concentrate will then be processed through a purification circuit which will remove the last impurities and also separate the h eavies from the lights. The final products of the process plant are a concentrate of heavy rare earth and a concentrate of light rare earth.

The tailings produced from the hydrometallurgical process will be pumped to a thickening facility located by the hydromet tailings storage facility (TSF). The solids will be dewatered in few steps using different technologies and then transported by truck and disposed mechanically into the TSF. This TSF is thus believed to be subject to progressive restoration throughout the mine life. Then the final section is to be restored at the end of the mine life as well as the other sites with varying infrastructures. The hydromet tailing storage facility will require further investigation and design work as the project advances into the next stages.

A total of 10 MW will be needed to power both the mine site and the metallurgical site and will be provided by a new power line to be connected to the Hydro-Quebec network.

In 2010, testwork at SGS Canada Inc. in Lakefield (Ontario) was directed toward examining a known recovery process employing aggressive conditions for extraction of rare earth elements (acid baked leaching). By early 2011, it had become evident that much less aggressive conditions than anticipated were possible for the extraction of the particular minerals present in the Kipawa ore (room temperature leaching); this allowed a substantial improvement in simplifying the projected process plant design.

The present study is based on metallurgical test work results dating prior to June 1, 2013. A pilot plant was performed during the summer of 2012 with a Composite of ore taken from a bulk sample coming from surface trenches. Then a series of variability samples were taken from trenches and core samples from 18 large caliber drill holes in order to make eight (8) Composites and also a Global Composite in order to verify if the process was valid for the entire ore deposit. Results showed lower recovery compared to the PEA study but it also showed that the process works for the entire ore body and also where the process needs to be optimized in order to improve the recovery.

From these previous results, a new Master Composite representing the ore body is ready for further piloting which is planned for the fall of 2013, to further improve the ore processing plant.

ANNUAL OPERATING SUMMARY

|

|||||

Production

|

Unit

|

Year -1

|

Year 1

|

Year 2 to 15 (avg.)

|

Year 15.2

|

| Reserve mined |

Mt

|

0.022

|

0.870

|

1.348

|

0.000

|

Waste mined

|

Mt

|

0.468

|

0.928

|

1.233

|

0.000

|

Strip Ratio (waste : ore)

|

1.1

|

0.9

|

|||

| Tonnes processed |

Mt

|

0.000

|

0.884

|

1.332

|

0.232

|

| Overburden |

Mt

|

1.328

|

0.000

|

0.000

|

0.000

|

Mixed REE concentrate

|

t

|

0

|

2,657

|

3,759

|

250

|

Mixed LREE concentrate

|

t

|

0

|

1,507

|

2,203

|

146

|

Mixed HREE concentrate

|

t

|

0

|

1,150

|

1,556

|

104

|

ANNUAL PRODUCTION REE LIGHT AND HEAVY CONCENTRATES (t)

|

||||

REO

|

Year 1

|

Year 2-15 (avg.)

|

Year 15.2

|

Year 1-15.2 (avg.)

|

| Light Concentrate | ||||

| Cerium (Ce2O3) |

727

|

1,049

|

69

|

1,018

|

| Lanthanum (La2O3) |

337

|

541

|

36

|

523

|

| Praseodymium (Pr6O11) |

94

|

131

|

9

|

127

|

| Neodymium (Nd2O3) |

349

|

482

|

33

|

469

|

| Heavy Concentrate | ||||

| Samarium (Sm2O3) |

83

|

113

|

8

|

110

|

| Europium (Eu2O3) |

11

|

15

|

1

|

14

|

| Gadolinium (Gd2O3) |

83

|

115

|

7

|

112

|

| Terbium (Tb4O7) |

16

|

22

|

1

|

21

|

| Dysprosium (Dy2O3) |

106

|

144

|

9

|

141

|

| Holmium (Ho2O3) |

24

|

32

|

2

|

31

|

| Erbium (Er2O3) |

73

|

97

|

7

|

95

|

| Thulium (Tm2O3) |

11

|

14

|

1

|

14

|

| Ytterbium (Yb2O3) |

62

|

81

|

7

|

79

|

| Lutetium (Lu2O3) |

7

|

9

|

1

|

9

|

| Yttrium (Y2O3) |

674

|

913

|

60

|

890

|

The capital cost estimate covers the development of the mine, ore processing facilities and infrastructure required for the Kipawa HREE project based on the application of standard methods of achieving a feasibility study with an accuracy of ± 15%. The capital costs have been estimated at $374.4 million, of which $257.99 million are direct costs and $67.56 million are indirect costs such as engineering, procurement, construction management, owner’s costs and an overall 15% contingency cost of $48.83 million as outlined below:

Capital Cost Items

|

Cost

(Million $ CAD)

|

| Off-Site Installation near Temiscaming town | |

Main Sub-Station / Hydro-Quebec Power / Parking

|

9.76

|

| Inter-Site Services | |

| Power line 44kV / Communications / Part of Access road |

13.35

|

| Mine Site | |

| Mining Equip / Pre-Prod./ Roads / Shop / …and other |

41.92

|

| Processing Plant Site | |

Support Infrastructures

|

23.27

|

Process Plant

|

137.21

|

Fresh Water Supply

|

4.79

|

Tailing Storage Facilities / Pipelines / Effluent treatment

|

27.69

|

Plant Site Sub Total

|

192.96

|

Total Direct Costs

|

257.99

|

Total Indirect and Owner’s Costs

|

67.56

|

Overall Contingency (15%)

|

48.83

|

Total Costs

|

374.4

|

Operating Cost Expenditures (OPEX)

The operating cost estimate was made for each step and compiled by Roche. The operating cost for the Matamec Kipawa operation covers mining, ore transportation, ore processing, tailings and water management, general and administration fees as well as infrastructure and services. The project operating cost estimate is based on the following main parameters:

- Tonnes of mineralized rock and waste mined per year: 2.5 million;

- Tonnes of mineralized rock milled per year: 1.3 million;

- Tonnes of mixed HRE concentrate: 1,516 tpa;

- Tonnes of mixed LRE concentrate: 2,137 tpa;

- Total manpower required for operation: 229 employees.

| Unit |

Average

|

|

| Net Metal Return (NMR)* |

$ /kg TREO

|

46.97

|

| Mining |

$ /kg TREO

|

4.97

|

| Processing** |

$ /kg TREO

|

13.35

|

| G&A |

$ /kg TREO

|

3.18

|

| Cash Costs |

$ /kg TREO

|

21.53

|

Production of mixed contained Total Rare Earths concentrate

|

tpa

|

3,653

|

*NMR = Grade x Recovery x Revenue

|

||

**Processing includes tailings management costs

|

||

The Rare Earth Elements (REEs) are typically defined as the fifteen lanthanide elements including yttrium and scandium; they form a group of technology enabling materials that are critical inputs for a wide range of everyday consumer products as well as a large number of cutting edge technologies. Strong magnetic, optical, electronic and catalytic properties have made certain rare earth compounds indispensable to a substantial portion of global industry, including but not limited to the automotive, consumer electronics, medical equipment and green technology sectors.

The demand for heavy rare earth materials is expected to benefit from strong growth, particularly in the case of dysprosium, terbium and yttrium, which are likely to realize swiftly expanding consumption from both the permanent magnet and phosphor powder sectors. The permanent magnet sector (neodymium and dysprosium and to a lesser degree terbium) is generally forecasted to realize strong gains in annual consumption through the entirety of the next seven years. The combination of tightening Chinese supply along with growing demand suggests terbium, dysprosium and several other HREEs will see appreciating price levels. Though demand for yttrium is expected to expand.

The Rare Earth Oxide prices used for the economic evaluation are based on a contracted market survey by Asian Metals (one of world’s largest metallurgical information providers) in conjunction with discussions with key industrial end-users which were important in defining the forecasted final prices of each rare earth oxide. Other sources consulted for review of the historical pricing data were websites and reports from Metal Pages, Roskill Information Service Limited and Industrial Minerals.

REO PRICES – 2016 FORECAST

|

|||||

Rare Earth Oxides

|

FS Market Price Ex-Works

Mine-Site (US$/kg REO) |

Refining Cost (%)

|

REO Price* Ex-Works Mine-Site

(US$/kg REO) |

Quantity Sold LOM (est.)

(t REO) |

|

| Cerium |

Ce

|

$5.90

|

30

|

$4.13

|

15,479

|

| Lanthanum |

La

|

$5.95

|

30

|

$4.17

|

7,952

|

| Praseodymium |

Pr

|

$75.40

|

30

|

$52.78

|

1,930

|

| Neodymium |

Nd

|

$75.00

|

30

|

$52.50

|

7,132

|

| Samarium |

Sm

|

$6.85

|

30

|

$4.80

|

1,679

|

| Europium |

Eu

|

$1,100.00

|

30

|

$770.00

|

215

|

| Gadolinium |

Gd

|

$59.40

|

30

|

$41.58

|

1,696

|

| Terbium |

Tb

|

$1,076.00

|

30

|

$753.20

|

321

|

| Dysprosium |

Dy

|

$713.00

|

30

|

$499.10

|

2,137

|

| Holmium |

Ho

|

$53.60

|

40

|

$32.16

|

474

|

| Erbium |

Er

|

$63.60

|

40

|

$38.16

|

1,063

|

| Thulium |

Tm

|

$1,200.00

|

40

|

$720.00

|

32

|

| Ytterbium |

Yb

|

$56.70

|

40

|

$34.02

|

555

|

| Lutetium |

Lu

|

$1,400.00

|

40

|

$840.00

|

55

|

| Yttrium |

Y

|

$29.40

|

30

|

$20.58

|

13,522

|

*REO price after deduction of refining and transport – Ex-works Matamec plant-site

|

|||||

The Project is subject to a joint venture agreement (the “JVA”) between Matamec and Toyotsu Rare Earth Canada Inc. (“TRECan”), a subsidiary of TTC (see press release dated July 12, 2012 for more details on the JV and the JVA). As at the date hereof, Matamec holds a 51% and TRECan a 49% interest in the Project (see press release dated August 8, 2013). The JVA contains a provision under which TTC shall become the off taker of the production from the Project, under the terms and conditions set out in the JVA and in the off-take agreement to be negotiated and executed by the parties. Negotiations to convert the agreement into contractual volumes will follow the completion of the FS. TRECan is a well-recognized strategic partner that has funded $16.0 million to Matamec to complete the FS.

ECONOMIC ASSUMPTIONS

|

||||

Rare Earth Oxides

|

PEA Market Price Forecast

(FOB China 2016 US$/kg REO) |

FS Market Price Forecast

(Ex-Works Mine-Site US$/kg REO) |

Quantity Sold per year (avg. est.) (t REO)

|

Est. Revenue LOM** ('000's)

|

| Cerium (Ce2O3) |

$5.00

|

$5.90

|

1,018.4

|

$63,926

|

| Lanthanum (La2O3) |

$10.00

|

$5.95

|

523.2

|

$33,120

|

| Neodymium (Nd2O3) |

$75.00

|

$75.00

|

469.2

|

$374,453

|

| Praseodymium (Pr6O11) |

$75.00

|

$75.40

|

127.0

|

$101,886

|

| Samarium (Sm2O3) |

$9.00

|

$6.85

|

110.5

|

$8,049

|

| Europium (Eu2O3) |

$500.00

|

$1,100.00

|

14.1

|

$165,486

|

| Gadolinium (Gd2O3) |

$30.00

|

$59.40

|

111.6

|

$70,521

|

| Terbium (Tb4O7) |

$1,500.00

|

$1,076.00

|

21.1

|

$241,636

|

| Dysprosium (Dy2O3) |

$750.00

|

$713.00

|

140.6

|

$1,066,608

|

| Holmium (Ho2O3) |

$65.00

|

$53.60

|

31.2

|

$15,246

|

| Erbium (Er2O3) |

$40.00

|

$63.60

|

70.0

|

$40,565

|

| Thulium (Tm2O3)* |

-

|

$1,200.00

|

2.1

|

$22,824

|

| Ytterbium (Yb2O3)* |

-

|

$56.70

|

36.5

|

$18,870

|

| Lutetium (Lu2O3) |

$320.00

|

$1,400.00

|

3.6

|

$46,496

|

| Yttrium (Y2O3) |

$20.00

|

$29.40

|

889.6

|

$278,292

|

Exchange Rate (CAD $/US $)

|

-

|

1.0 / 1.0

|

||

Discount Rate (%)

|

8%

|

10%

|

||

*At PEA, no value was attributed to Tm and Yb because no prices were available at date of publication.

|

||||

**Est. Revenue LOM is

calculated from the (Price After Refining x Quantity Sold LOM) –

Quantity Sold is rounded to nearest tonne (see table pg. 11).

|

||||

Economic Analysis

An economic/financial analysis of the project has been carried out using a cash flow model. The model is constructed using annual cash flow in constant money terms (second quarter 2013). No provision is made for the effects of inflation. As required in the financial assessment of investment projects, the evaluation is carried out on a so called “100% equity” basis, i.e. the debt and equity sources of capital funds are ignored.

TECHNICAL ASSUMPTIONS |

|||

Item

|

Base Case Value

|

Unit

|

|

Total Ore Mined

|

19.77

|

M tonnes

|

|

Processing Rate

|

1.332

|

M tonnes / year

|

|

Life of Mine

|

15.2

|

years

|

|

Average Combined Process Recovery

|

70

|

%

|

|

Average Mining Cost

|

7.03

|

($ / tonne mined)

|

|

Average Processing Cost

|

36.57

|

($ / tonne milled)

|

|

Average General & Administration Costs

|

8.71

|

($ / tonne milled)

|

|

A capital cost breakdown by item provides a preliminary capital spending schedule over a 2-year pre-production period. The total pre-production capital expenditures are evaluated at $374.4 million, excluding the working capital. The total sustaining capital requirement is evaluated at $37.7 million which includes rehabilitation expenditures. A working capital equivalent of 3 months of total annual operating costs is maintained throughout the production period. Apart from the first fills and spare parts included in the pre-production capital expenditures, an additional working capital outlay of $11.2 million is required. The total operating costs are estimated at $1.181 billion for the life of the mine or an average of $58.9/tonne milled. The financial results indicate a positive before-tax NPV of $260 million at a discount rate of 10%, a before-tax IRR of 21.6% and a payback period of 3.88 years.

REVENUES AND EXPENDITURES

|

||

Item

|

Base Case

|

Unit

|

| Total Mine Revenue |

2.548

|

billions $ CAD

|

| Pre-production Capital Expenditures |

374.4

|

millions $ CAD

|

| Sustaining Capital Expenditures (Incl. Rehab.) |

37.7

|

millions $ CAD

|

| Additional Working Capital Requirement |

11.2

|

millions $ CAD

|

| Mine Rehabilitation Costs |

23.1

|

millions $ CAD

|

| Total Operating Cost |

1.181

|

billions $ CAD

|

| Total Before-tax Cash Flow |

960

|

millions $ CAD

|

| Before-tax NPV @ 10% |

260

|

millions $ CAD

|

| Before-tax NPV @ 8% |

344

|

millions $ CAD

|

| Before-tax NPV @ 6% |

450

|

millions $ CAD

|

| Before-tax IRR |

21.6

|

%

|

| Before-tax Payback Period |

3.88

|

years

|

| Total After-tax Cash Flow |

602

|

millions $ CAD

|

| After-tax NPV @ 10% |

128

|

millions $ CAD

|

| After-tax NPV @ 8% |

185

|

millions $ CAD

|

| After-tax NPV @ 6% |

257

|

millions $ CAD

|

| After-tax IRR |

16.8

|

%

|

| After-tax Payback Period |

4.12

|

years

|

A sensitivity analysis has been carried out on the base case scenario described above to assess the impact of changes in REE market prices, total pre-production capital costs and operating costs on the project’s NPV @ 10% and IRR. Each variable was examined independently. An interval of ±30% with increments of 10% were used for all three variables. The project’s before-tax viability is not significantly vulnerable to the under-estimation of capital and operating costs, taken independently. The net present value is more sensitive to variations in operating expenses. As expected, the NPV is most sensitive to variations in REE prices, followed by operating costs and by capital costs.

Environment, Permitting and Social Acceptability

Environment and Permitting

Matamec has always been proactive and has respected the rules outlined by the different government authorities.

After the first drilling campaign outlined a good quality deposit (2009), Matamec decided to begin a baseline study of the territory around the deposit. Enviréo Conseil, an independent firm from Rouyn-Noranda, Quebec, was hired to perform the study of water, fish, aquatic plants and mud samples which were taken from 5 sites, instead of the 3 recommended by regulation.

Then in spring 2012, Matamec hired the firm Golder Associates Ltd to complete the baseline study that was started two years before and also to perform an Environmental and Social Impact Assessment which is planned to be completed by Q1 2014.

A comprehensive program of geochemical characterization has been conducted during the last year in order to classify all the varying rock types to be mined, the ore, the overburden and also all the different waste and residue to be generated by the mine and process operation. The waste rock, ore, and magsep tailings are classified as non-acid generating. The hydromet tailings sample analyzed is classified as acid generating based on its high sulfur content but all sulphur occurs as sulphate which is already oxidized and therefore not expected to generate acidity in the future.

Further radiological analyses of leachates were carried out for safety purpose and as required under Directive 019 of the MDDEFP to evaluate the level of risk associated with possible leaching of radiogenic parameters from mine wastes, magnetic separation rejects and hydrometallurgical tailings. None of the samples analysed are classified as high risk waste based on radionuclide analyses in leachate. Analyses were also done on the solids themselves and so far the hydrometallurgical tailings are classified as potentially radiogenic, but manageable. The implementation of proper management programs in regards to radioactive elements will ensure the safety of the workers and of the population during operation and after the mine closure. Furthermore, additional geochemical analysis will be conducted before detailed engineering in order to determine all the final classification and design parameters for the infrastructures related to the tailings management.

Hydrological and hydrogeological studies were carried out as well. From the collected information, a water management plan has been put together and will be optimized at further stages in the project. A site-wide water quality evaluation study is underway to determine future water treatment needs at the mine site and hydrometallurgical waste storage sites.

From all the information collected during the FS, it was decided to proceed with dewatered tailings even if it is much more expensive in operating costs in order to minimize environmental risks related to the tailings management. It will also allow the operator to consider progressive site restoration during mine operation.

The mining lease was filed before the end of March 2012. The project notice to begin the Federal environmental permitting process was submitted before the end of Q1 2013. The restoration plan and environmental impact study commenced at the beginning of May 2012 and are still ongoing but are well advanced. The official application for the Certificate of Authorization to the MDDEFP is planned to be submitted by winter 2014.

Social Acceptability

Since 2009, the Matamec Team is making social acceptability a priority for the Kipawa Project, as well, the Company is committed to being visible to the people in the region as a socially responsible neighbour.

In March 2012, our regional office was opened in downtown Temiscaming, creating visibility and allowing easy accessibility to information for people in the region. Regular meetings and discussions are held with the First Nations Communities, with the signature of a Memorandum of Agreement with them. Under this agreement, the First Nations communities completed their own cultural impact assessment study describing the past and current traditions and resources used in the project area. They also completed their socio-economic baseline report for the project. These studies will contribute to the preparation of the environmental effects assessment of the Kipawa project.

There is an open and constant communication between the Matamec team and the citizens. Public information meetings are held throughout the region, highlighting our commitment to dialogue and opportunities for questions about the project.

We strive to understand all stakeholders concerns and maintain our strategy of transparency executed through active and consistent communication.

NI 43-101 Disclosure

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements by the following persons, or under the supervision of, all of whom are independent Qualified Persons as set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101").

Qualified Person

|

Consulting Firm

|

Contribution

|

| Guy Saucier, Eng. | Roche Ltd. | Project Supervisor |

| Yann Camus, Eng. | SGS Geostat | Mineral Resource |

| Pierre Casgrain, Eng. | Roche Ltd. | Mining |

| Al Hayden, P. Eng. | EHA Engineering Ltd. | Metallurgy |

| Eric Poirier, Eng. | GENIVAR Inc. | Infrastructure |

| Michel Mailloux, Eng. | Golder Associates | Environment |

| Marc Rougier, Eng. | Golder Associates | Geotechnical |

| Mayana Kissiova, Eng. | Golder Associates |

Tailings & Water Management

|

| Valerie Bertrand, P. Geo. |

Golder Associates

|

Geochemistry

|

| Gaston Gagnon, Eng. | SGS Geostat | Marketing |

| Michel Bilodeau, Eng. | Roche Ltd. | Financial Model |

Readers are advised that Mineral Resources not included in Mineral Reserves do not demonstrate economic viability. Mineral Resource estimates do not account for mineability, selectivity, mining loss and dilution. These Mineral Resource estimates include Inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that Inferred Mineral Resources will be converted to Measured and Indicated categories through further drilling, or into Mineral Reserves, once economic considerations are applied.

Technical information in this press release was reviewed and adopted by Bertho Caron, VP Project Development & Construction (Eng.) and Aline Leclerc, VP Exploration (Geo.), Matamec’s Qualified Persons for this press release.

The full feasibility study, prepared in accordance to the NI 43-101 compliant technical report, will be filed under Matamec Explorations’ profile on SEDAR at www.sedar.com within 45 days.

Conference Call

Matamec will be hosting an analyst conference call on Wednesday, September 4, 2013 at 10:00 a.m. (Eastern Time). Participants may join the call by dialing toll free 1-800-381-7839 or 1-416-981-9000. A live webcast of the call will be available through our website at: www.matamec.com. A copy of the presentation will be available on our website one hour prior to the webcast.

A taped replay of the conference call will be available starting that same day at 12:00 p.m. ET by dialing 1-800-558-5253 or 416-626-4100 and entering passcode 21667794#, until September 18 at midnight.

About Matamec

Matamec Explorations Inc. is a junior mining exploration company whose main focus is in developing the Kipawa HREE deposit with TRECan.

In parallel, the Company is exploring more than 35 km of strike length in the Kipawa Alkalic Complex for rare earths-yttrium-zirconium-niobium-tantalum mineralization on its Zeus property. Since 2008, Matamec discovered many potential showings. Particularly, it drilled the PB-PS Zone in the fall of 2012 and identified similar Eudialyte-Mosandrite/Yttro-Tantanite/Britholite associated mineralization founded at the HREE Kipawa Deposit. This type of mineralization is presently known over 200 metres long and it opens laterally and at depth. The Company plans to drill these extensions later this year.

The Company is also exploring for gold, base metals and platinum group metals. Its gold portfolio includes the Matheson JV property located along strike and in close proximity to the Hoyle Pond Mine in the prolific gold mining camp of Timmins, Ontario. In Quebec, the Company is exploring for lithium and tantalum on its Tansim property and for precious and base metals on its Sakami, Valmont and Vulcain properties.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of Canadian Securities legislation. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as “scheduled”, “anticipates”, “expects” or “does not expect”, “is expected”, “scheduled”, “targeted”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements contained herein include, without limitation, statements relating to mineral reserve estimates, mineral resource estimates, realization of mineral reserve and resource estimates, capital and operating costs estimates, the timing and amount of future production, costs of production, success of mining operations, the ranking of the project in terms of cash cost and production, permitting, economic return estimates, power and storage facil ities, life of mine, social, community and environmental impacts, rare metal markets and sales prices, off-take agreements and purchasers for the Company’s products, environmental assessment and permitting, securing sufficient financing on acceptable terms, opportunities for short and long term optimization of the Project, and continued positive discussions and relationships with local communities and stakeholders. Forward-looking statements are based on assumptions management believes to be reasonable at the time such statements are made. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Although Matamec has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Factors that may cause actual results to differ materially from expected results described in forward-looking statements include, but are not limited to: Matamec’s ability to secure sufficient financing to advance and complete the Project, uncertainties associated with Matamec’s resource and reserve estimates, uncertainties regarding global supply and demand for rare earth materials and market and sales prices, uncertainties associated with securing off-take agreements and customer contracts, uncertainties with respect to social, community and environmental impacts, uncertainties with respect to optimization opportunities for the Project, as well as those risk factors set out in the Company’s year-end Management Discussion and Analysis dated December 31, 2012 and other disclosure documents available under the Company’s profile at www.sedar.com. Forward-looking statements contained herein are made as of the date of this news release and Matamec disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

"Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release."

For further information please contact:

André Gauthier, President

Tel: (514) 844-5252

Email: info@matamec.com

Edward Miller, Director IR

Tel: (514) 844-5252 ext. 205

Email: edward.miller@matamec.com

No comments:

Post a Comment